GetMyOffer Capital One Credit Card is one of the most committed credit card organizations on the current list. The customers must take advantage of this opportunity, as these offers must not only be defined over time but also disseminated to continue to focus on customer interests.

Do you maintain a good credit rating? If yes, GetMyOffer Capital One is purely for you. You can apply for the new credit card at the website address Getmyoffer.capitalone.com.

Not only that! GetMyOffer.CapitalOne.com, which has been pre-approved, can help restore your credit score and advance the appearance of your credit report. The bank keeps the three principal credit reporting agencies informed about its financial activities.

| Portal Name | GetMyOffer Capital One |

|---|---|

| Access Mode | Online |

| Service Field | Financial Transactions |

| Access Language | English |

| Site | Official Site |

GetMyOffer Capital One Usage Guide

To sign into their registered Capital One account, account holders must follow a specific procedure. If you require help, kindly follow the steps below to complete the entire login process: –

- Visit the GetMyOffer Capital One registration portal at the address getmyoffer.capitalone.com.

- Check the latest updates option on the home screen.

- Submit your credentials in the corresponding section.

- Make sure to verify the username and password you entered.

- After verifying, click on the Login button to access the account and use the services offered here.

GetMyOffer Capital One Code

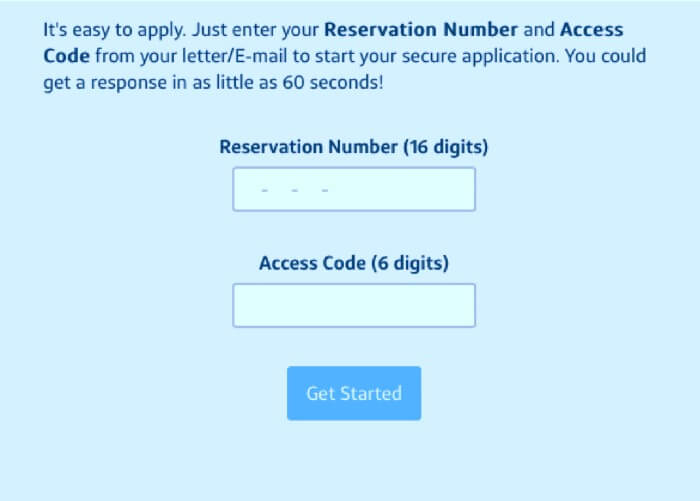

The Capital One access code can be found at the end of the offer letter directly below the ticket number. After receiving the reservation number in the offer letter, check below to see if users need to find the access code.

It is a 6-digit code and, unlike the reservation number, the digits that compose it are not separated by hyphens. As soon as the cardholders sign up on the official website, they will receive the offer letter for the GetMyOffer Capital One reservation number by email.

Many potential customers are recognized and recommended by numerous companies with the idea of doing business with ideal customers. Some companies borrow these emails and send them to select customers with offers. GetMyOffer Capital One is a lender that offers credit cards via email to customers having a decent credit score.

It is very likely that you have already received this email. The bigger question is how you would react to such an offer from Capital One.

The GetMyOffer Capital One Card

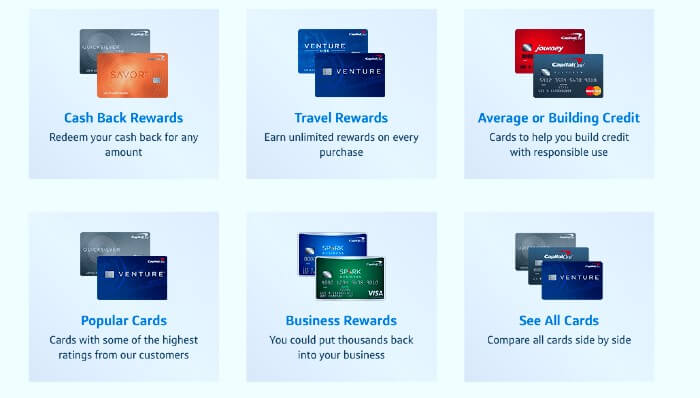

In the GetMyOffer Capital One segment, the Quicksilver credit card is probably one of the most well-known as one of the best credit cards for money lovers. With Quicksilver credit cards, customers can earn up to 1.5% cashback on every retail transaction they make.

GetMyOffer Capital One was officially established by Richard Fairbank and Nigel Morris in Richmond, Virginia. Today the company has annual sales of several billion US dollars and is listed on the New York Stock Exchange with COF representation.

From small businesses to commercial and residential customers, anyone can subscribe to GetMyOffer Capital One. The process is fairly simple but demands minimal computer skills along with internet browsing.

It would be enough for the person to visit the official website of the capital getmyoffer.capitalone.com, register on the website and that’s it. Yes, if the user is a new customer signing up for the first time, the process will take a little more time, discovery, and relevant documentation. It is worthy to note that registering on the official portal is a must to use the services of this card.

These documents can include proof of identity, proof of income, and other details. There are also cases where users are obliged to submit their reservation number and GetMyOffer Capital One access 6-digit usage code.

The GetMyOffer Capital One Card offers some incredible services which make life easy for the customers to a good extent. These services are easy to use after signing up on the official portal.

Most customers who have used the services offered by this card are happy with it and hardly anyone has any complaint. Ths Capital One company has made sure that the online portal is quite simple and highly secured to be used for every registered user.

Credit cards have come and gone over the years, but GetMyOffer Capital One has been at the forefront and remains one of the best card companies in the market that offers the best rewards to the registered users.

You will be asked to submit the reservation code along with the access code (both details will be provided in your Capital One email)

Can I Use GetMyOffer Capital One Card?

Capital One credit cards are not just any card. So if you receive a prequalification letter from Getmyoffer by email, consider yourself lucky.

However, it is not necessary that they provide you with the card. You must meet all the requirements, otherwise, you could also be disqualified after receiving a pre-approval email. Before responding to an email from Getmyoffer, make sure you abide by a set of the requirements listed below.

- You must have a good credit score of 650 to 700 and above.

- The age limit to use the services offered by this card is 18 or above.

- Only the lawful resident of the USA are allowed to access the online portal.

- You must not be involved in debt payments or bankruptcies with any other company.

- Maintaining a good credit rating is a must to get the GetMyOffer Capital One Card.

- You should not apply for additional credit cards after submitting your Capital One credit card application.

- You must possess a valid ID along with a valid social security number.

The best GetMyOffer Capital One credit card for good customers is Secure MasterCard from Capital One. The services offered by this card is extremely reliable.

Capital One, one of the most dedicated banks in America, now has an official website. GetMyOffer Capital One’s official website is getmyoffer.capitalone.com. The Card has introduced an online portal to help out the customers. If people don’t know Capital One, that’s where the credit is.

Your credibility is maintained by the authorities that provide details regarding your financial situation. The document shows your loans and the repayment amount and whether there have been any defaults or arrears. Points are awarded based on the report and if they are perfect the score is high.